41+ can i deduct mortgage insurance premiums

Web Deduction for mortgage insurance premiums as qualified residence interest under Section 102 of the Act The deduction for certain mortgage insurance premiums has. Web Assuming 12 payments your deduction is 1200.

Ev Energy Credits New Tax Deductions

Enter that figure on line 13 of Schedule A.

. Ad Understand The Home Buying Process Better. Web Eligible W-2 employees need to itemize to deduct work expenses. Be aware of the phaseout limits however.

Our Simple Guide Will Help You Understand Common Mortgage Terms. However even if you meet the criteria above. Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI.

However there are some exceptions to this rule. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Mortgage Insurance Premiums are amortized over 84 months but only until the loan is paid.

Web If you itemize you can deduct interest on up to 750000 of mortgage debt if you bought your home after December 15 2017 interest is deductible up to 1 million. The itemized deduction for mortgage insurance premiums has. The PMI deduction is reduced by 10 percent for each 1000 a filers income exceeds the AGI limit.

Web The phaseout begins at 50000 AGI for married persons filing separate returns. SOLVED by TurboTax 5832 Updated 1 month ago. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

Web Can I deduct private mortgage insurance PMI or MIP. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below.

Web Basic income information including amounts of your income. Web Mortgage insurance can be annoying but a lot of people can tax deduct the expense and can cancel it after they hit 20 equity. If you are tired of paying mortgage.

The insurance contract was issued in 2007 or. Web The insurance policy must be for home acquisition debt on a first or second home. Web Mortgage insurance premiums and taxes are typically deductible when they are paid by the borrower.

The mortgage is secured by your first or second home. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. You pay mortgage insurance premiums for your mortgage.

If you are claiming itemized deductions you can claim the PMI deduction if. You will itemize your deductions. Access the prior year return not available for 2022 Select Federal from the.

Per IRS Publication 936 Home Mortgage Interest Deduction page 8 middle paragraph states. Web That does change the answer. Remember the deduction is only good through tax year 2020.

No deduction is allowed for the unamortized balance if the mortgage is satisfied before its term.

Is Homeowners Insurance Tax Deductible In 2023 The Zebra

Is Mortgage Insurance Tax Deductible Bankrate

Is Pmi Tax Deductible Credit Karma

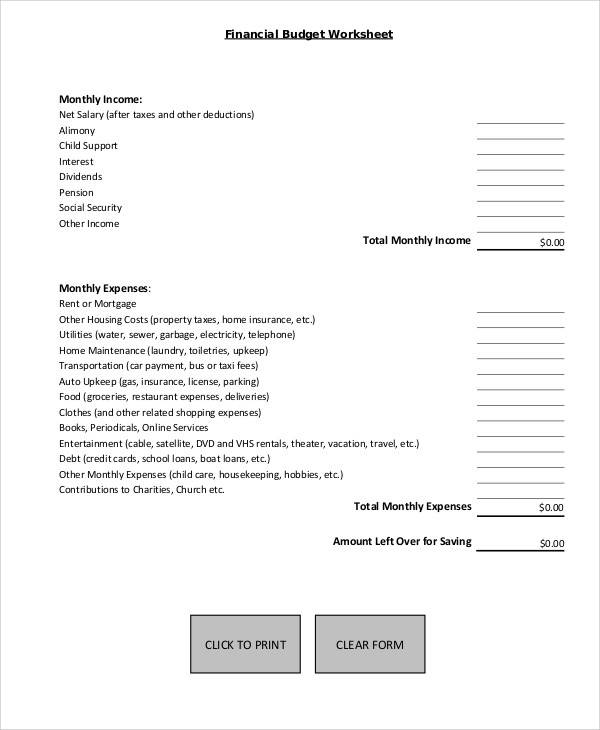

Free 41 Sample Budget Forms In Pdf Ms Word Excel

Business Credit

Is Pmi Tax Deductible The Insurance Bulletin

What Is Pmi Understanding Private Mortgage Insurance

![]()

Ev Energy Credits New Tax Deductions

Learn About The Mortgage Insurance Premium Tax Deduction 2023 Pakth

Pdf 7 3 Mb Gildemeister Interim Report 3rd Quarter 2012

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Business Succession Planning And Exit Strategies For The Closely Held

Pdf Solution Manual Cost Accounting William Max Choi Academia Edu

Business Credit Workshop

Is It A Wise Idea To Buy A House In India Now Quora

Is Private Mortgage Insurance Pmi Tax Deductible

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction